Anusha Thavarajah, Regional Chief Executive Officer, Allianz Asia Pacific, said: “2023 has been an exceptional year for Allianz Asia Pacific, signified by the remarkable achievements and profitable growth since we embarked on flagship initiatives with a key focus on distribution transformation. Against the backdrop of Asia's ever-evolving and dynamic economic landscape, we performed at much higher levels, maintained and improved our positions in key markets, reinforcing the stability and resilience of our diverse footprint.

Committed to accelerating growth, we've significantly scaled up agency recruitment and activation through game-changing initiatives, such as the inaugural INSEAD partnership and MDRT acceleration. Pivotal to our strategy, these efforts have yielded the right results, as reflected in the double-digit growth of new business value (NBV) and annualised new premiums (ANP) from new agents.

The successful renewal of our exclusive bancassurance distribution agreement with HSBC in Asia Pacific, the first-of-its-kind banca value-share model, has also seen strong growth in NBV.

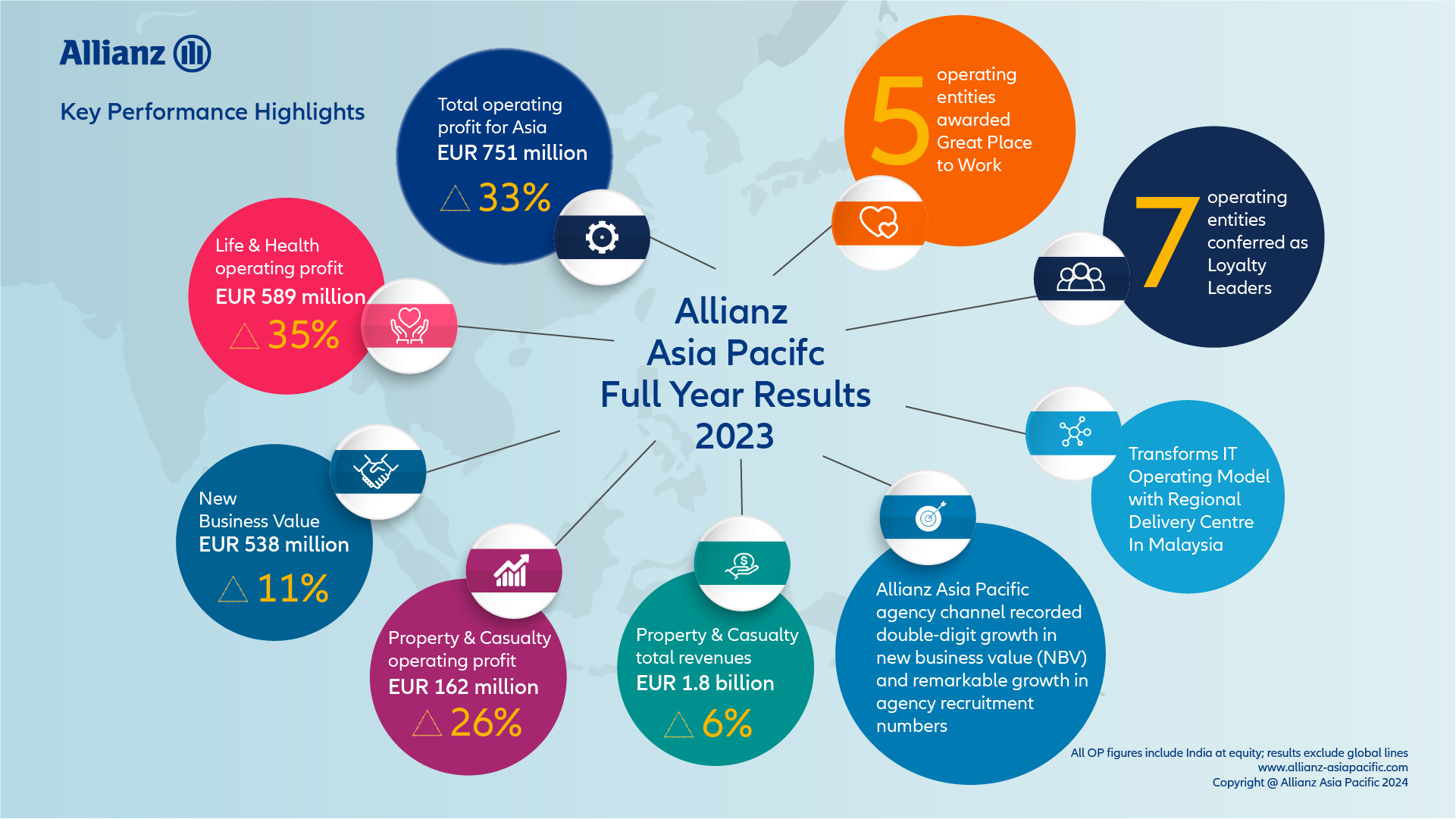

We have impacted many lives this year, with seven operating entities recognised as Loyalty Leaders (LL). This acknowledgement from our customers fuels our ambition to extend this accolade across all markets as we strive to touch more lives and secure their future.

From ground-breaking agency recruitment numbers and strategic partnerships to innovative product developments and technological advancements, we have set new standards of excellence. Our success from strategy to execution is made possible by our people, who are at the heart of our organisation. We have successfully established ourselves as an employer of choice, evidenced by high employee engagement levels and the attainment of 'Great Place to Work' certification in five markets in the region.

We are extremely proud of what we have achieved together and our journey has only just begun.”

Aaron Fryer, Regional Chief Financial Officer, Allianz Asia Pacific, said: “We are proud to share that Allianz Asia Pacific has surpassed all our key financial targets, achieving an impressive 33 per cent increase in our operating profits in Asia this FY2023.

Despite the tighter market conditions coupled with headwinds faced at the start of 2023, our Life & Health (L/H) business demonstrated robust and sustainable growth with operating profits and new business value (NBV) growth at 35 per cent to EUR 589 million and 11 per cent to EUR 538 million respectively. The strong double-digit growth in both profitability measures is driven by our consistent and well-measured strategy towards our distribution and product initiatives, observed across our major markets in Taiwan, Thailand, Malaysia, Indonesia, and China.

Our Property & Casualty (P/C) business witnessed strong profitability growth with our revenue - a six per cent increase to EUR 1.8 billion. Our operating profit increased by 26 per cent to EUR 162 million, bolstered by solid performances in Malaysia, Singapore, China, and Thailand.

These exceptional results demonstrate the culmination of solid collaboration through our 'One Allianz' approach towards becoming the region's leading life insurer and the fastest growing profitable property and casualty insurance service provider in Asia. As we continue to forge and embark on the opportunities that lie ahead, we remain steadfast, focusing on delivering superior propositions to our customers - setting the stage for accelerated progress in the coming years.”